The Complete Guide to Selling Land By Owner in Ohio: From Corn Belt to Appalachia

Ohio's land market is a study in contrasts. Drive 200 miles from northwest Ohio's arrow-straight $15,000/acre corn rows to southeastern Ohio's $2,000/acre Appalachian hollows, and you've crossed one of America's steepest land value gradients. Add Columbus's explosive urban sprawl (Central Ohio land speculation), century-old severed mineral rights (southeast coal/gas legacy), and the CAUV agricultural tax program (rollback penalty traps), and you face a selling challenge unlike any neighboring state.

Unlike North Dakota (zero transfer tax), Ohio charges conveyance fees (~$4/$1,000 = 0.4%). Unlike states requiring attorneys (NY) or mandatory disclosure (NC), Ohio allows title company closings and has no land disclosure law. But beneath this apparent simplicity lurk region-specific complexities. Here's your complete guide.

The CAUV Rollback Penalty: Ohio's Hidden Closing Cost

What is CAUV? Ohio's Current Agricultural Use Value program lets farmland owners pay property taxes on agricultural value (not market value). Land worth $15K/acre (market) might be valued at $2K/acre (CAUV) for tax purposes = $1,300/year taxes instead of $10,000/year. Massive savings for working farmers.

When does rollback trigger? When CAUV land is sold and converted from agricultural to non-agricultural use (residential development, commercial, industrial). Removal from CAUV program triggers "recoupment" of tax savings.

How much is the penalty? 3 years of "back taxes" = difference between CAUV value and market value for past 3 years × tax rate. On valuable land near Columbus: $30K-$100K+ common. Even on rural land: $5K-$20K typical.

Who pays? Seller typically responsible for rollback taxes accrued during their ownership. Buyer will demand: (1) Seller pays rollback at closing, OR (2) Purchase price reduced by rollback amount. Either way, seller bears cost.

How to avoid? If buyer is a farmer keeping land in agricultural production = no rollback (CAUV continues). But if selling to developer, residential buyer, or removing from CAUV for any reason = penalty due.

Check before listing: Contact county auditor, request CAUV status and estimated rollback calculation. Factor into sale price. Many Ohio sellers shocked at closing when $40K rollback bill appears. Plan ahead.

Strategic timing: If planning to sell in 2-3 years, consider removing land from CAUV NOW (pay rollback yourself spread over time) so buyer doesn't face penalty = more attractive sale.

Ohio's Regional Land Price Canyon: Why Northwest = 7x Southeast

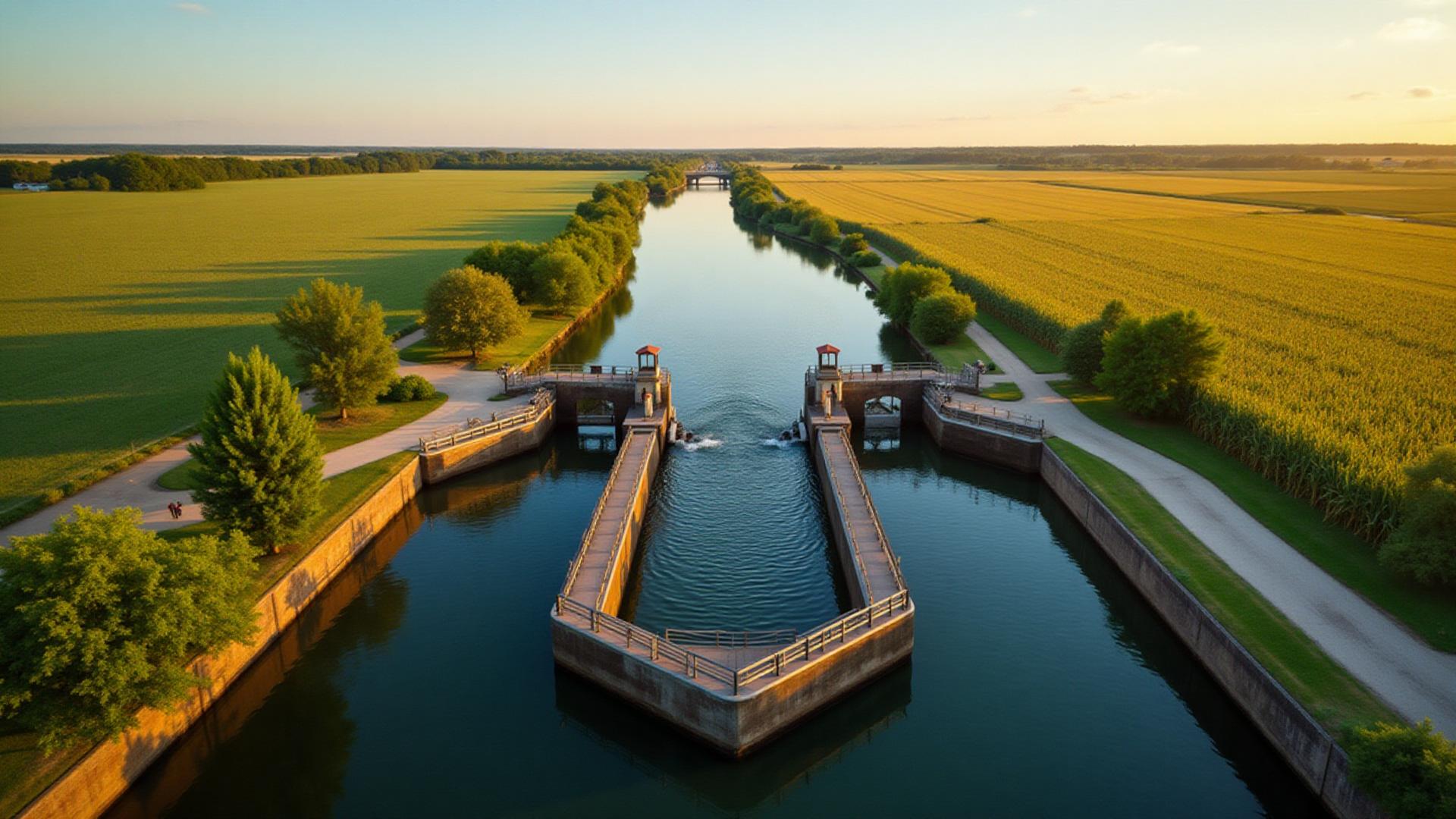

Northwest Corn Belt superiority: Flat land from last Ice Age, black soil (high organic matter), excellent natural drainage + tile drainage systems, 180+ day growing season, consistent rainfall, corn/soybean yields 200+ bushels/acre (top 10% nationally), cash rent $250-$350/acre, land values $7K-$15K/acre. This is PREMIUM Midwest farmland rivaling Iowa/Illinois.

Limited supply - multi-generational farm families hold land for decades. When rare parcel hits market = multiple farmers bidding. Driven by agricultural income, not speculation.

Western Ohio solid ground: Slightly rolling (vs NW flat), still excellent soil, good yields, $6K-$12K/acre. More available land, mix of crops + livestock, Amish influence (Darke, Shelby counties - cash buyers, no financing). Affordable entry for beginning farmers. Solid agricultural fundamentals.

Central Ohio urban explosion: Columbus = 15th largest US metro, fastest-growing Midwest city. Land within 30-mile radius = speculation-driven. Farmland worth $8K/acre for crops, but $30K+/acre for development potential (subdivide into $100K lots).

Zoning = everything. If land has water/sewer access + residential zoning = gold. If landlocked + agricultural zoning = worth farm value only. Wide price variation: $5K-$40K/acre depending on location/zoning. Buyers = developers and builders (not farmers). Risk: If development doesn't happen, you overpaid. But if Columbus keeps growing, huge appreciation potential. Market driven by FUTURE use, not current income.

Northeast rust belt mixed: Cleveland/Akron/Canton Rust Belt cities = population decline/stagnation. However, some excellent farmland (Wayne, Holmes counties), Amish country (Holmes County = largest Amish settlement, strong cash buyer market), hobby farm demand. Range: $4K-$10K/acre. Market softer than Western Ohio but stable.

Southeast Appalachian struggle: Unglaciated hill country (Ice Age didn't flatten land), steep slopes, thin rocky soil, limited flat land, hardwood forests, beautiful but agriculturally poor. Coal mining legacy + oil/gas (Utica Shale) = severed mineral rights on 30-40% of land.

Economic decline - youth leave for jobs elsewhere, population aging/falling. Market = recreational/hunting, not agriculture. Out-of-state buyers (Ohio's cheapest land). Financing difficult (banks reluctant on SE land). Values: $2K-$5K/acre, often under $3K. Timber value often exceeds land value. Selling can take 12-24 months (slow market).

Conveyance Fees: Ohio's Transfer Tax Substitute

Ohio doesn't call it "transfer tax" - it's "real property conveyance fee." State mandatory portion: $1 per $1,000 (0.1%) - all 88 counties. County portion: Each county can add up to $3 per $1,000 additional - most do. Total typical: $4 per $1,000 = 0.4% of sale price.

Calculation Examples:

- $100K land sale = $100 state + $300 county = $400 total

- $250K land sale = $250 state + $750 county = $1,000 total

- $500K land sale = $500 state + $1,500 county = $2,000 total

County variations: Franklin (Columbus) = $3/$1,000 county, Cuyahoga (Cleveland) = $4/$1,000, Hamilton (Cincinnati) = $3/$1,000. Check YOUR county.

Who pays? Typically seller, but negotiable. Contract should specify. Unlike some states (NJ - buyer traditionally pays), Ohio = seller convention but not law.

When paid? At closing, recorder won't record deed without fee payment. Paid to county recorder.

Comparison to other states: Much cheaper than NJ ($15-$30/$1,000 = 1.5-3%), NY ($4-$17/$1,000 = 0.4-1.7%), similar to NC ($2/$1,000 = 0.2%). More than ND (zero). Middle of pack nationally. On $250K land sale: OH = $1,000, ND = $0, NC = $500, NY = $1,000-$4,250, NJ = $3,750-$7,500. Ohio reasonable.

Southeastern Ohio Mineral Rights: Coal Legacy and Shale Boom

Geographic concentration: Mineral rights issues concentrated in Appalachian Ohio (southeast). NOT statewide issue like North Dakota (75% severed). In northwest/western/central Ohio = mineral rights rarely severed, not valuable issue.

Historic coal mining: SE Ohio = historic coal region (Hocking, Perry, Athens, Belmont, Harrison counties). When land sold 1900s-1950s, coal rights often retained by mining companies. Many properties today = surface owner has no coal rights. Coal companies (or successors) own coal = can theoretically mine (though most coal seams exhausted). Title search reveals retained coal rights.

Oil/gas boom 2010-2015: Utica Shale and Marcellus Shale formations discovered beneath SE Ohio. Horizontal drilling + fracking unlocked gas. Land rush: Companies leasing mineral rights, paying $3K-$6K/acre bonuses + 18-20% royalties. Some landowners made millions. Drilling peaked 2014, slowed 2015+ (low gas prices), but still active in Harrison, Belmont, Monroe, Noble, Guernsey counties.

Severed mineral rights: 30-40% of SE Ohio land has severed minerals (previous owner retained gas/oil/coal when selling surface). When selling land with severed minerals: Surface buyer knows they don't control subsurface, mineral owner can access surface for extraction (drill pads, access roads, pipelines). Significantly reduces surface value. Must disclose in sale.

If you own minerals: Choice = sell minerals with surface (higher price), OR reserve minerals and keep them (continue receiving royalties if producing). Most SE Ohio sellers reserve minerals if producing. Separate mineral sale = mineral broker, different process.

Title complexity: SE Ohio titles require extensive mineral search (100+ years of coal/gas deeds). Use experienced SE Ohio title company or attorney familiar with mineral issues. Cheap title search = missed severed minerals = buyer walks away when discovered.

No Mandatory Disclosure - But Do It Anyway

Ohio Revised Code 5302.30 = residential disclosure law. Applies to homes (1-4 units). Does NOT apply to vacant land or agricultural land. Result: Legally, you are NOT required to complete disclosure form when selling vacant land.

However: Common law fraud/misrepresentation still applies. If you KNOW of material defects and don't disclose = liable for fraud.

Material defects include: Environmental contamination (old dump, underground tanks, chemical spills), flood-prone land, access issues (landlocked, disputed easement), zoning restrictions (unbuildable), underground utilities, wetlands (no build), old foundations/wells, prior mining activity.

Best practice: Complete Ohio REALTORS® Vacant Land Disclosure form anyway, even though not legally required. Why? (1) Protects seller from future fraud claims - "I disclosed everything I knew", (2) Sophisticated buyers expect disclosure - if you don't provide, they wonder what you're hiding, (3) Honest disclosure builds trust = smoother transaction.

If you truly don't know answer to question: Write "Unknown" - this is acceptable. Don't guess or assume. Only disclose what you actually know. Attorney can provide disclosure form or draft custom one for your property.

Why Sell Land By Owner in Ohio

Save $7,500-$60,000+ in commissions: 6% on $125K land = $7,500. On $1M development land = $60,000. With Ohio's reasonable conveyance fees (0.4%), saving commission makes huge difference in net proceeds.

Conveyance fees already low: At 0.4%, Ohio's transfer costs already cheaper than NJ/NY. Add 6% commission = 6.4% total. FSBO reduces to just 0.4%. On $250K sale, that's $15,000 in your pocket vs $1,000 in fees.

Title company option: Don't need attorney in Ohio (unlike NY). Can use title company for $500-$1,500 = further cost savings.

Control regional strategy: Ohio's five distinct regional markets require different approaches. NW Corn Belt = target farmers directly. Central = target developers. SE = recreational buyers. You know your land and region better than distant realtor.

No disclosure requirement: Unlike NC/NY, Ohio doesn't require land disclosure = simpler FSBO process (though still recommend voluntary disclosure).

Common Ohio Land Selling Challenges

Challenge 1: CAUV Rollback Shock

Problem: Seller lists land, finds buyer, goes to closing, discovers $45,000 CAUV rollback penalty due because buyer is developer (not farmer). Seller never knew land was in CAUV program. Deal nearly falls apart.

Solution: Check CAUV status with county auditor BEFORE listing. Get rollback estimate. Factor into asking price or require farmer-buyer who will keep CAUV active. Knowledge = no surprises.

Challenge 2: Southeast Mineral Rights Title Nightmare

Problem: Selling 80 acres SE Ohio, buyer orders title search, discovers coal rights retained by 1947 deed to mining company (now bankrupt and ownership unknown), gas rights leased to three different companies with conflicting claims. Title company refuses to insure. Sale dies.

Solution: Order mineral title search BEFORE listing (if SE Ohio property). Resolve mineral defects with attorney before marketing. Curative work takes 6-12 months but makes land saleable. Don't wait until buyer appears.

Challenge 3: Central Ohio Development Gamble

Problem: Land near Columbus, seller thinks it's worth $30K/acre for development. Lists at that price. Sits 18 months with no offers. Turns out zoning restricts to agricultural (no subdivision allowed). Worth only $8K/acre farm value.

Solution: Check zoning BEFORE pricing. If agricultural-only = price for farm value. If can rezone for residential = investment in rezoning process may be worthwhile before selling. Don't speculate on buyer rezoning.